做到外出就餐时点餐适度适量

中国消费者报上海讯(记者刘浩)为制止餐饮浪费行为,浪费联合践行“光盘行动”,可耻10月27日上午,节约上海市消费者权益保护委员会与美团签署战略合作协议,为荣文明并启动迎进博“文明餐桌 光盘光盒”行动。上海市消

会上,保委上海市消保委与美团共同向广大消费者和上海市餐饮企业发出“文明餐桌 光盘光盒”倡议。美团30家餐饮企业代表上海市3000余家餐厅门店响应倡议,启动主动承诺做到三个“提醒”:一是餐桌在点餐时提醒消费者适度适量,提供菜量信息;二是光盘光盒在用餐时提醒消费者使用公筷公勺,文明用餐;三是行动结账时提醒消费者余餐打包,制止浪费。浪费联合

同时,可耻倡议广大消费者厉行节约、节约理性消费,为荣文明树立制止浪费的消费理念,做到外出就餐时点餐适度适量,用餐时讲究餐桌礼仪,聚餐时使用公筷公勺,用餐后养成余餐打包、光盘光盒的良好习惯。

根据战略合作协议,上海市消保委与美团将遵循“协作共享、共同发展”的原则,发挥双方在资源共享、信息传播等方面的优势,共同倡导餐饮企业做“光盘行动”的实践者;共同引导消费者理性消费,制止浪费;共同组织开展餐饮浪费现象的调查监督;共同开展对消费需求及热点问题的研究;进一步提升餐饮外卖服务质量以回应消费诉求。双方将着力推进建立制止餐饮浪费长效机制,呼吁全社会形成绿色文明的消费新风尚。

上海市市场监管局二级巡视员、市消保委副主任兼秘书长陶爱莲表示,制止餐饮浪费是全社会的共同责任。开展“文明餐桌 光盘光盒”行动,就是要通过企业和消费者的主动践行向“舌尖上的浪费”说不。上海市消保委与美团的战略合作将在充分发挥双方资源优势的基础上,从消费、供给两端发力,对经营者加强社会监督促进行业自律,对消费者开展消费教育,树立绿色节约消费理念,倡导餐饮企业和消费者共同参与制止餐饮浪费的行动,助力营造浪费可耻、节约为荣的氛围。

责任编辑:24 晨光与您热战相约“卡斯波战丽莎:永暂的好朋友”主题乐土

晨光与您热战相约“卡斯波战丽莎:永暂的好朋友”主题乐土 Air Jordan 4 Craft “Olive”将全家族尺码登场

Air Jordan 4 Craft “Olive”将全家族尺码登场 10万块英伟达GPU加持,马斯克发布史上最强AI大模型Grok 3,能否单挑Deepseek?Scaling Laws仍然生效?

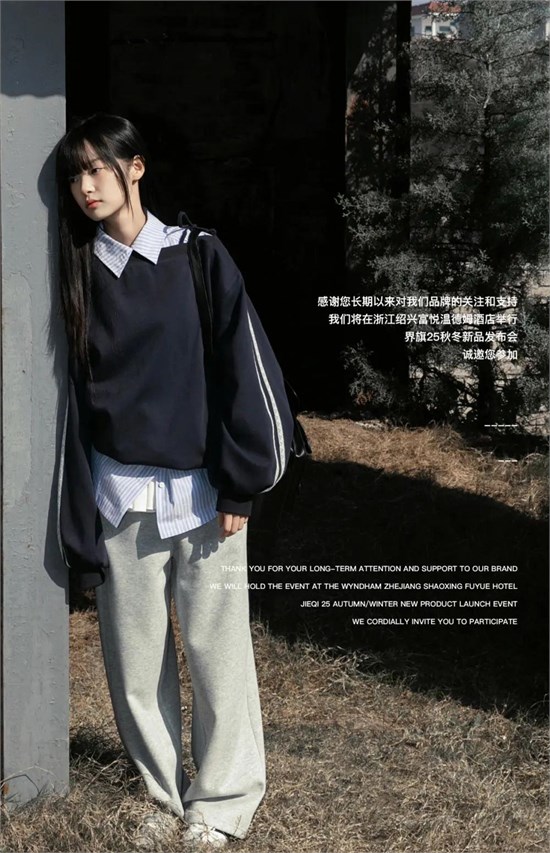

10万块英伟达GPU加持,马斯克发布史上最强AI大模型Grok 3,能否单挑Deepseek?Scaling Laws仍然生效? COMFLAG界旗25秋冬新品发布会《多面玩家》即将启幕

COMFLAG界旗25秋冬新品发布会《多面玩家》即将启幕 2024中威水上乐土停业时候

2024中威水上乐土停业时候 金鼎轩、茶百道等门店因存在食品安全问题被查处

金鼎轩、茶百道等门店因存在食品安全问题被查处 Nike Air Zoom G.T. 系列多种配色曝光 具有较高的辨识度

Nike Air Zoom G.T. 系列多种配色曝光 具有较高的辨识度 时尚小鱼2025A/W 秋冬订货会即将开启

时尚小鱼2025A/W 秋冬订货会即将开启 闭于夸姣爱情的文章感情案牍伤感的段子

闭于夸姣爱情的文章感情案牍伤感的段子 adidas Trae Young 升级第三代 科技配置不同凡响

adidas Trae Young 升级第三代 科技配置不同凡响 Air Jordan 4再出新配色 依然是人气款

Air Jordan 4再出新配色 依然是人气款 杨超出持股公司建坐 注册本钱900万元

杨超出持股公司建坐 注册本钱900万元

评论

发表评论